cook county property tax

Matches from this site are not guaranteed. There are currently four exemptions that must be applied for or renewed annually.

|

| Property Tax Burden In The Chicago Region Cmap |

It will be the taxpayers responsibility to pay the remaining 200 to the Cook County Treasurers Office.

. Cook County has one of the highest median property taxes in the United States and is ranked 91st of the 3143 counties in order of median property taxes. Cook County contains 134 municipalities in its region the most well known being the City of Chicago which is the County seat where the central offices of Cook County are located. By visiting the Clerks Office on the 4th Floor of the Cook County Building 118 North Clark Street Chicago IL 60602. The median property tax in Cook County Illinois is 3681 per year for a home worth the median value of 265800.

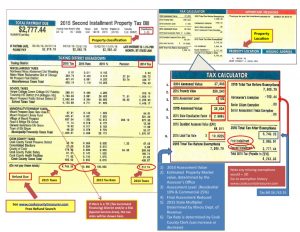

The Cook County property tax system is complex. Plus the Illinois Department of Revenue. The maximum annual property tax deferral shall not exceed 5000 per year. The Second Installment Property Tax Bill can now be downloaded from the Cook County Treasurers website.

The county says the bills will go. Toggle navigation 847 750-4626. Once you search by PIN you can pay your current bill online or learn additional ways to pay by clicking More Tax Bill Information on the next page. Go straight to the map.

Read The Pappas Study Search your property tax history. CHICAGO WLS -- The Cook County property tax sale process that can result in evictions and robs their communities of generational wealth. Cook County voters approve property tax increase for the forest preserves. Cook County collects on average 138 of a propertys assessed fair market value as property tax.

Their long-delayed property tax bills will be available online Tuesday and due Dec. For example a taxpayer with an annual tax bill of 5200 will only be able to defer 5000. In this section we. The Cook County Treasurers Office provides payment status for current tax years and the ability to pay online.

The county has a wealth of map information that it wants to share with the public. The best source for your PIN is your deed or tax bill or other documents from the purchase of your home. Registration will be open from Friday December 2 2022 to Friday December 9 2022. The Portal consolidates information and delivers Cook County taxpayers a one-stop customer service website.

The Cook County Property Tax Portal is the result of collaboration among the elected officials who take part in the property tax system. More Cook County Mapping Applications. The Cook County Treasurers Office website was designed to meet the Illinois Information Technology. The Cook County Treasurers Office website was designed to meet the Illinois Information Technology Accessibility.

Properties with unpaid 2020 property taxes that were due last year will be offered for sale. Cook County Tax Assessors Office Jennifer Thornton Chief Appraiser 209 N PARRISH AVE Adel GA 31620 Phone. How much you pay in taxes depends on your propertys assessment assessments of other properties appeals exemptions and local tax levies. Cook County homeowners may take advantage of several valuable property-tax-saving exemptions.

Tax bills across the county rose by 614 million. 118 North Clark Street Third Floor Room 320 Chicago IL 60602. The Homeowner Exemption Senior Citizen Homestead Exemption Senior Citizen Assessment Freeze Exemption and the Home Improvement Exemption. Second Installment Property Tax bills are now available by clicking Your Property Tax Overview in the purple box below.

The next Annual Tax Sale is scheduled to take place in 2024. More than 45000 properties are eligible for. Cook County WLS -- The second installment of Cook County property taxes are usually due by August but those bills have not even been sent out to taxpayers yet. That means the second-installment of property owners 2021 tax bills will be more than 150 days late amid months of bureaucratic wrangling and finger.

Cook County Forest Preserve leaders are asking voters for a 42 million property tax hike for revenue to improve the preserves including acquiring 3000 acres restoring 20000 acres and for. 10 digit PIN Address Intersection. Access the 20-Year Property Tax History. The 2020 Annual Tax Sale was completed on November 21 2022.

The Cook County Treasurers Office website was designed to meet the Illinois Information Technology Accessibility Act. Tax Year 2021 First Installment Due Date. Tax Year 2021 Second Installment Property Tax Due Date. Registration for the 2020 Supplemental Annual Tax Sale is now open.

Search to see a 5-year history of the original tax amounts billed for a PIN. Contact me Richard Shapiro Attorney today to schedule a free consultation. Friday December 30 2022. Billed Amounts Tax History.

The Cook County tax sale begins next week on November 15. Latino neighborhoods will see the most significant tax increase in gentrifying Chicago neighborhoods. The Cook County Property Tax Portal created and maintained by the Cook County Treasurers Office consolidates information from the elected officials who take part in the property tax system and delivers Cook County taxpayers a one-stop customer service website. The Better Government Association conducted an analysis.

Cook County property owners are about to get an early gift this holiday season. Please check the lower left corner of the bill to ensure that you have received the correct property tax exemptions. The tax would cost property owners 150 on average more a month and would mean 40 million more for the forest preserves. Cook County Clerks Office.

Begin your search by entering an address property identification numberPIN or intersection. Fritz Kaegi Cook County Assessor. For information on prior years taxes have your 14-digit Property Index Number PIN ready and contact the County Clerks Real Estate Tax Services Division. It involves the Assessors Office the Board of Review the Cook County Clerk and the Cook County Treasurer.

Homeowners are paying 535 of the increase. Get professional help with property tax issues in Cook County Illinois.

|

| Chicago Property Taxes 4 Things Driving Up Your Bills |

|

| The Tax Divide Chicago Tribune |

|

| Last Chance To Appeal Your Lakeview Property Taxes Lakeview Il Patch |

|

| Cook County 2016 Property Tax 2nd Installment Due August 1st |

|

| The Basics Fitzgerald Law Group P C |

Posting Komentar untuk "cook county property tax"